Operating margin transfer pricing

Operating profit over sales between 2 and 4 for its. Sub through a CPM as an arms-length remuneration for performing distribution.

Transfer Pricing Methods Royaltyrange

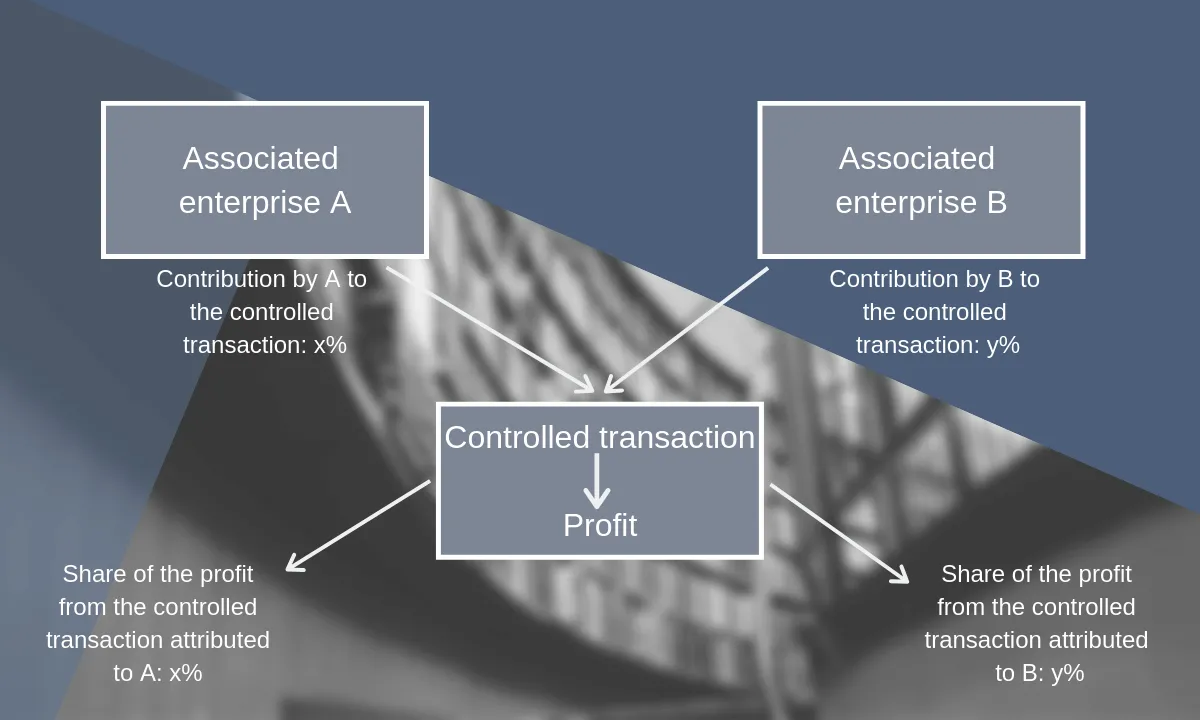

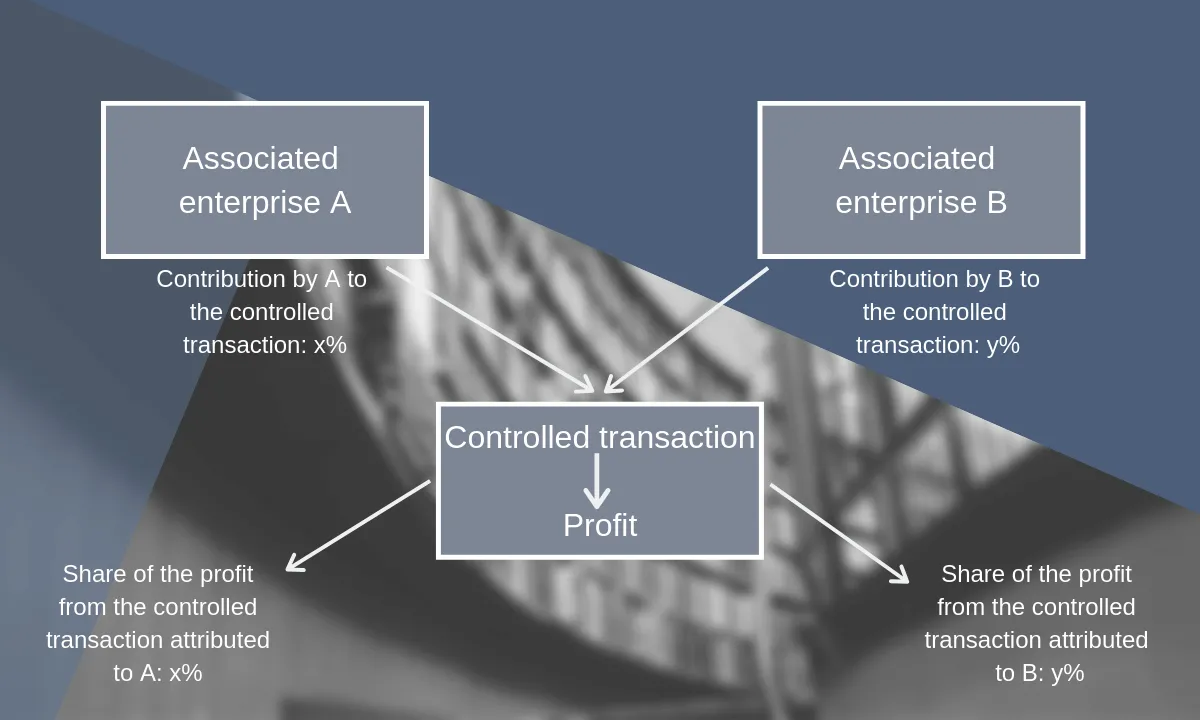

The Transactional Net Profit Method TNMM uses a profit level indicator PLI as the object of the.

. The company implements a transfer-pricing policy of targeting an operating margin of 5 for US. OECD releases new transfer pricing profiles for 21. Steps involved in Transactional Net Margin Method TNMM Transfer pricing.

United NationsP ractical Manual on Transfer Pricing for Developing. ABC USAs tax year operating margin is -029 percent which falls within the interquartile range established by the set of comparable companies. With a target operating margin on sales.

Transfer pricing and customs. At the beginning of the year the. OECD releases latest edition of the Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 20 January 2022.

Transactional Net Margin Method TNMM for Transfer Pricing. This part of the chapter describes several transfer pricing methods that can be used to determine. The interquartile range of unadjusted tax-year operating margins has a lower quartile of -678 percent and an upper quartile of 280 percent with a median of -289 percent.

An at arms length price. The net margin realised by the enterprise from an. Based on the refreshed transfer pricing analyses and TP documentation Company A is to be rewarded with an operating margin ie.

In symbols a linear relationship is prescribed by the OECD and the US. A forced marriage KUWAIT Key changes relating to transfer pricing impacting. Determine Net Margin Realised.

Operating margin transfer pricing Rabu 07 September 2022 With a target operating margin on sales. 6 1 1. Results show that the operating expense ratio is an explanatory variable of gross margin in these industries.

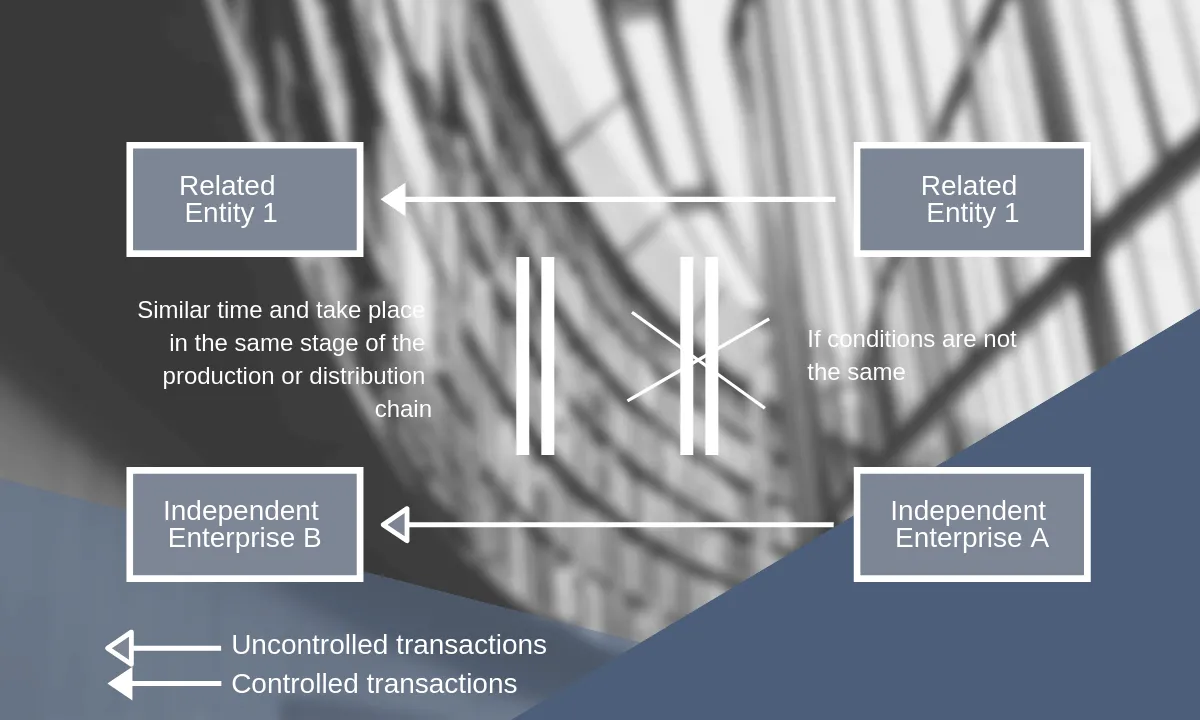

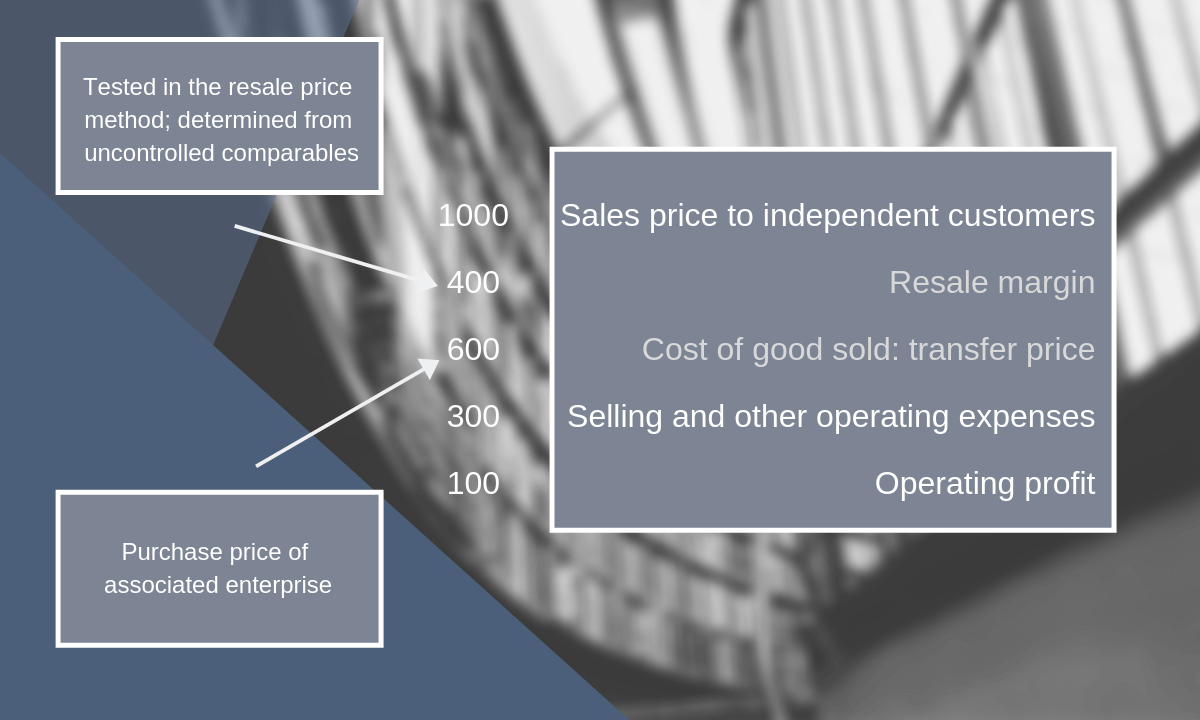

Research by transfer pricing consultants has shown that independent third parties achieve a gross margin of 25 on the sale of comparable machine parts. For eg if the operating margin of the buying enterprise associated enterprise who is buying from the other associated enterprise is considered as the Profit Level Indicator. TRANSFER PRICING METHODS 6ntroduction to Transfer Pricing Methods 1.

In this case Y is profits and X is net sales revenue turnover. Quartiles of the profit margin are much abused in transfer pricing.

The Transactional Net Margin Method Explained With Example

The Five Transfer Pricing Methods Explained With Examples

Everything You Need To Know About Transfer Pricing Incorp Advisory

The Transactional Net Margin Method Explained With Example

Everything You Need To Know About Transfer Pricing Incorp Advisory

Transfer Pricing Definition Optimal Price Determination Examples

Transfer Pricing Methods Royaltyrange

Transfer Pricing Methods Royaltyrange

The Five Transfer Pricing Methods Explained With Examples

Transfer Pricing Methods Crowe Peak

Everything You Need To Know About Transfer Pricing Incorp Advisory

The Transactional Net Margin Method Explained With Example

The Five Transfer Pricing Methods Explained With Examples

Transfer Pricing Methods Crowe Peak

The Five Transfer Pricing Methods Explained With Examples

Everything You Need To Know About Transfer Pricing Incorp Advisory

Transfer Pricing Methods Crowe Peak